Models 190 to 198

Skip information indexForm 192

Access to this option requires identification with an electronic certificate issued in the name of the declarant. If the declarant does not have an electronic certificate, it is necessary that the person making the presentation be authorized to present declarations on behalf of third parties, either by being registered as a social collaborator or by being authorized to carry out this procedure.

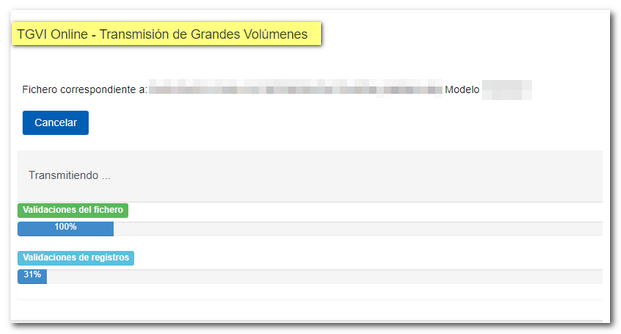

The submission is made using TGVI online, a system that validates whether the file contains correct and incorrect records, allowing partial submission of the correct records, downloading the incorrect records and a TXT file with the errors to, once corrected, send them through supplementary declarations.

We recommend that you clean up the census of your recipients using the tax identification service before filing your return to avoid identification errors. To do this you can use the option available on the website: "Checking a NIF of third parties for census purposes" located in "Help", "Tax Identification" of the "2025 Informative Declarations Campaign" section.

This query is also found in the procedures for model 030 within "Census, NIF and tax address".

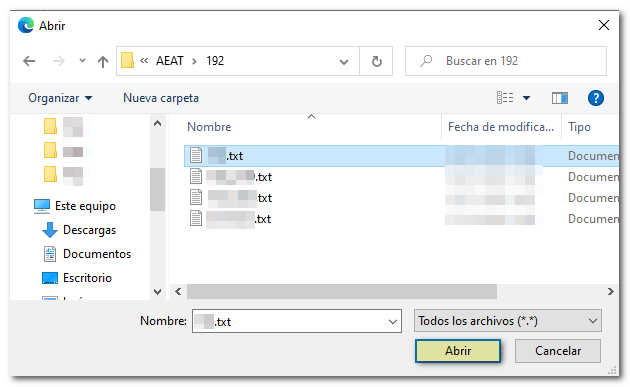

For electronic submission, you must have the file of the declaration you are going to transmit, with the data adjusted to the registration design of the current model 192.

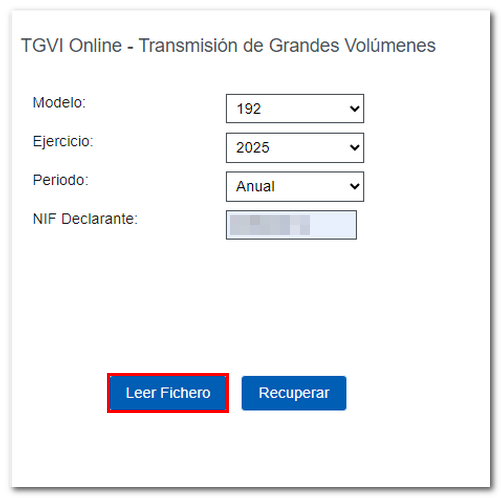

When accessing the presentation, model 192 will be selected by default. Select exercise 2025 and indicate the NIF of the declarant. Since it is an annual declaration, it will appear by default in the period box: "Annual".

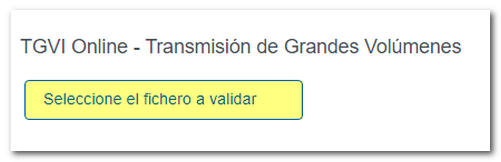

To send a new file press "Read File" and then "Select file to validate" to select the file. From the "Recover" option you can reload the last file validated by the application for that model, fiscal year and NIF . If you choose to validate a new file using the "Read file" option, any previous submission for the selected combination of Model + Fiscal Year + Period + NIF Declarant will be lost, since only the last validation is recovered.

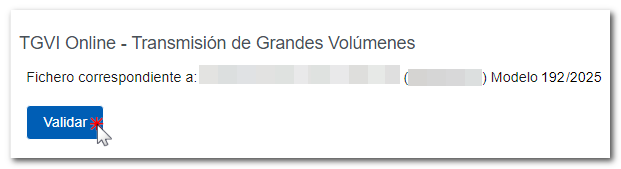

The name or company name of the declarant, NIF and model/year will be reported; Click "Validate" to start validating the file.

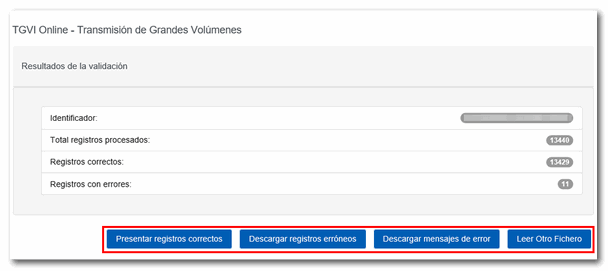

Once the file transmission and validation is complete, a summary of the result will be displayed; Please note that validation does not imply the submission of the declaration.

Once the file transmission and validation is complete, a summary of the result will be displayed; Please note that validation does not imply the submission of the declaration.

In the event that erroneous records are found, a breakdown of correct and erroneous records will be included.

From that moment on the presenter will be able to:

Submit correct records

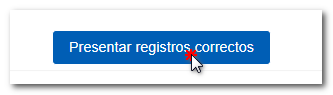

Click the "Submit Correct Records" button.

Check the "I agree" and "Sign and Submit" box to obtain the filing receipt.

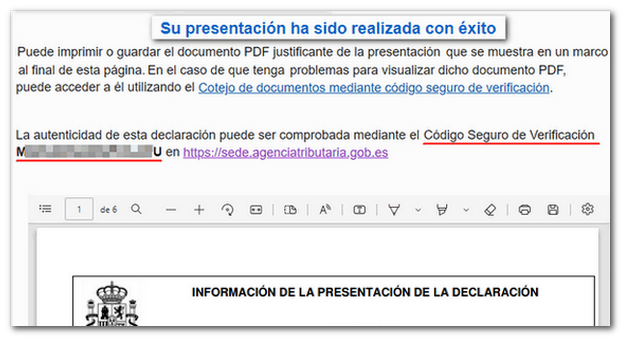

You will receive the corresponding submission receipt with the copy of the declaration in PDF , which you can save and print and includes the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter data).

If some records have not been submitted due to errors, once the errors have been corrected, you must proceed to submit the corresponding supplementary declaration for the rest of the records.

Download erroneous records

A file will be downloaded with the current registration design format and the total number of erroneous records. The Type 1 record (declarant's record) of said file will be consistent with the detail of the erroneous records.

Click "Download Error Logs" and you will be able to open or save the file to your computer.

The downloaded file will include, in the type 1 record, its own identification number as a supplementary declaration with the letter "C" and the supporting document number of the validated original declaration.

Download error messages

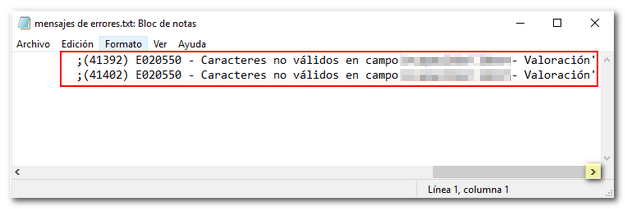

From this button you can retrieve a file with the details of the errors. This is a text file that contains a detail of the error for each incorrect type 2 record (Perceivers).

Click "Download Error Messages" to open or save the file to your computer.

The file will show the record of each type 2 error detail, with the line number of the original file and, at the end of each line, a description of the error that the record presents (it consists of a code and an error).

If the file has more than 1 million errors/records the file will be compressed in ZIP format.