Models 190 to 198

Skip information indexForm 194

The electronic submission of form 194 requires identification with a certificate or electronic DNI issued in the name of the declarant. If the declarant does not have an electronic certificate, it is necessary that the certified person who makes the submission be authorized to submit declarations on behalf of third parties.

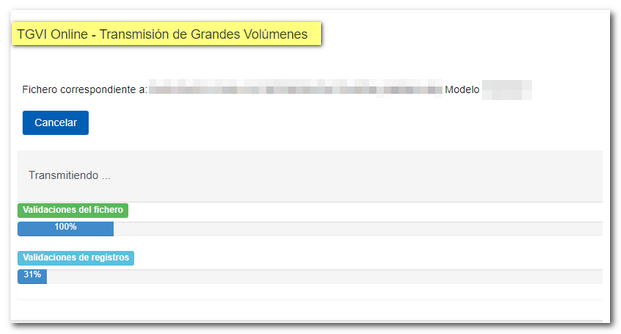

The submission is made through TGVI online, a system that validates whether the file contains correct and incorrect records, allowing partial submission of the correct records, downloading a file with the incorrect records and a file with the details of the errors so that, once corrected, they can be sent through supplementary declarations.

We recommend that you clean up the census of your recipients using the tax identification service before filing your return to avoid identification errors. To do this you can use the option available on the website: "Checking a NIF of third parties for census purposes" located in "Help", "Tax Identification" of the "2025 Informative Declarations Campaign" section.

This query can also be found in the procedures for model 030 within "Censuses, NIF and tax domicile"

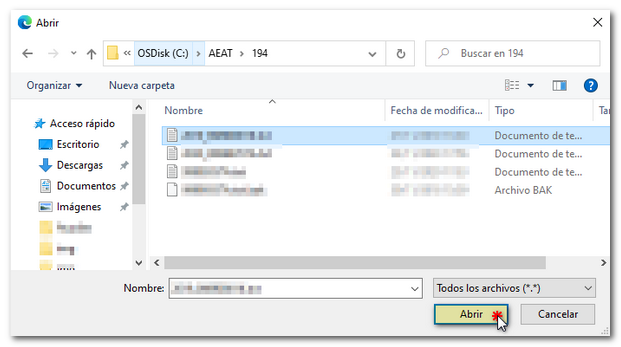

You must have the file of the declaration that you are going to transmit, with the data adjusted to the registration design of the updated model 194.

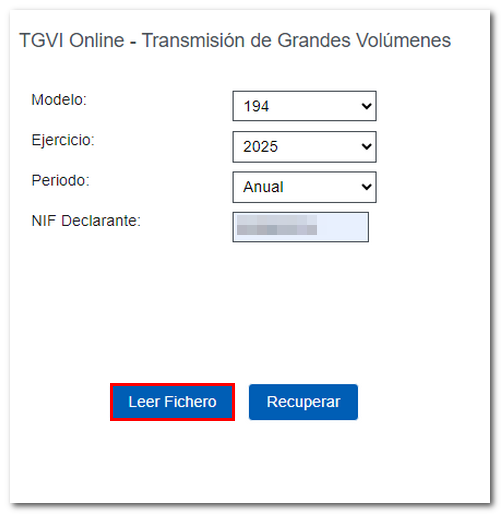

When accessing the presentation, select the electronic certificate and press "Accept". The 194 model will be selected by default; choose the 2025 tax year and indicate the NIF of the declarant. Since it is an annual declaration, it will appear by default in the period box: "Annual".

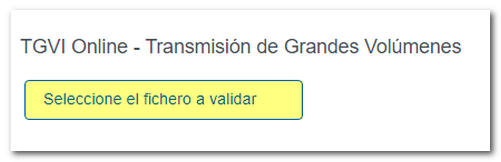

To send a file, press "Read File" and then "Select file to validate" to select the file. From the "Recover" option you can reload the last file validated by the application for that model, fiscal year and NIF .

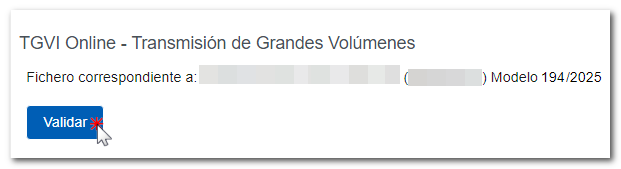

The name or company name of the declarant, NIF and model/year will be reported; Click "Validate" to start validating the file.

The name or company name of the declarant, NIF and model/year will be reported; Click "Validate" to start validating the file.

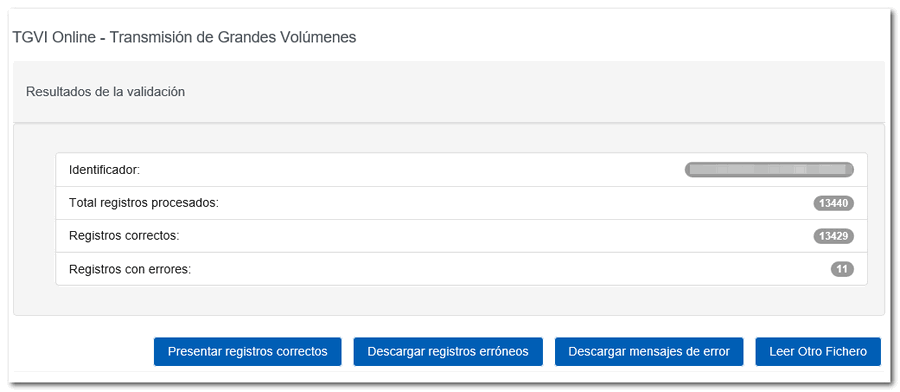

Once the file transmission and validation is complete, a summary of the result will be displayed; Please note that validation does not imply the submission of the declaration.

Once the file transmission and validation is complete, a summary of the result will be displayed; Please note that validation does not imply the submission of the declaration.

In the event that erroneous records are found, a breakdown of correct and erroneous records will be included.

From that moment on the presenter will be able to:

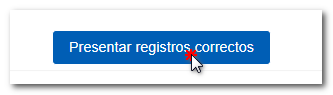

Submit correct records

Click the "Submit Correct Records" button.

In the next window, check the "I agree" box and click "Sign and Send."

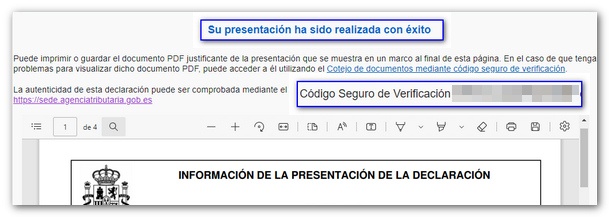

You will receive the corresponding submission receipt in an embedded PDF , which you can save and print, showing the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details). In addition, you will have an additional field that reports the total number of correct records submitted and the number of incorrect records. You can download and save document PDF to your computer.

If any of the records have not been submitted due to errors, once the errors have been corrected, you must proceed to submit the corresponding supplementary declaration for the rest of the records.

Download erroneous records

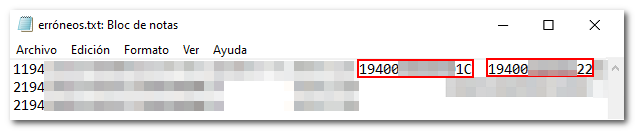

A file will be downloaded with the current registration design format and the total number of erroneous records.

Click "Download Error Logs", you can open or save the file to your computer.

The downloaded file will include, in the type 1 record, an identification number as a supplementary declaration with the letter "C" and the supporting document number of the validated original declaration.

Download error messages

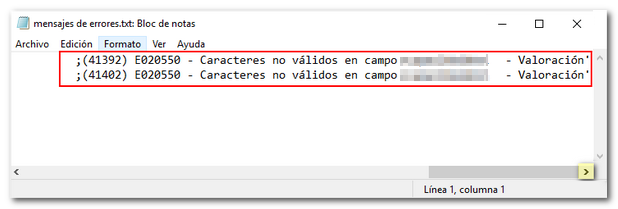

From this button you can recover a file with the details of the errors; This is a text file that contains a detail of the error for each incorrect type 2 record (Perceivers).

Click "Download Error Messages" and you will be able to open or save the file to your computer.

The file will show the record of each type 2 error detail, with the line number of the original file and, at the end of each line, a description of the error that the record presents (it consists of a code and an error).

If the file has more than 1 million errors/records the file will be compressed in ZIP format.